Chinese stocks plunge in worst end to Lunar Year on record

News24

23 Jan 2020, 17:44 GMT+10

Panic coursed through the world's second-largest equity market as investors sold stocks on concern a deadly virus will worsen over China's week-long trading break.

The Shanghai Composite Index settled 2.8% lower after the close of trading, its worst end to a Lunar Year in its three-decade history. More than 90% of the mainland's 4 000 stocks fell on volumes that were 20% above average, with foreign traders selling $1.7bn worth of the shares. The yuan weakened as much as 0.4% and government bond futures rose to the highest level since 2016.

Pressure is building on Beijing to contain a new SARS-like virus that's killed at least 17 people and infected hundreds. The coronavirus first appeared last month in the city of Wuhan in central China, a city with 11 million residents - more than in London or New York - that's now essentially in lockdown after officials halted public travel.

"Fear and panic are rampant," said Wang Daixin, a fund manager at Bristlecon Pine Asset Management Ltd. "It's hard to tell how bad things will get before a turn for the better. I didn't get out when I had the chance to, so now I might as well sit it out rather than lose money. Others are offloading at whatever cost."

The virus and its potential impact on the economy and financial system pose a growing challenge for President Xi Jinping. It comes at a time when the Communist Party is seeking to maintain stability in the face of a trade war with the US, the spread of swine fever, a debt mountain, rising corporate defaults and protests in Hong Kong.

China was criticised during the SARS epidemic 17 years ago for initially providing limited information and denying the scope of the problem.

A gauge of consumer-staples stocks - some of last year's top performers - extended this week's loss to 6.4%, the worst since October 2018.

The Lunar New Year is a typically strong season for traveling and spending as families gather for the celebrations. Macau casino stocks also tumbled as the city reported its second case of the novel coronavirus and announced it would cancel all Lunar New Year festivities.

In Hong Kong, where two cases have also been confirmed, the Hang Seng China Enterprises Index dropped 2.3%. China Life Insurance Co. slumped to its lowest level in a month.

Stocks plummet on Asian virus concerns

The final day before the Lunar New Year break is historically a good one for stock investors: since its launch in 1991, the Shanghai Composite Index had ended the session lower on only six occasions.

Shutting down Chinese markets has trained attention on the offshore yuan, as well as markets in Hong Kong and exchange-traded funds tracking Chinese stocks in New York or Europe.

It will add an element of speculation to their prices when mainland bourses are closed. Hong Kong traders will return to their desks on Wednesday, while exchanges in Shanghai and Shenzhen will reopen January 31.

In the US, owners of the more than $19bn that tracks Chinese stock ETFs will have less information in deciding how much the securities are worth.

The reaction from foreign investors can often be more severe: the Xtrackers Harvest CSI 300 China A-Shares fund, which holds mainland listed-shares only, fell twice as much as the underlying gauge earlier this week.

Without being able to trade for a week, investors are heading into the holiday blind. After an extended break last May, the Shanghai Composite fell 5.6% as investors reacted to escalating trade tensions with the US. The sell-off wiped out almost half a trillion dollars from Chinese equity values.

Bullishness fades

"There's going to be no way for investors to make a decision or change positions until post-Chinese New Year," said Gavin Parry, chief executive at Parry Global Group in Hong Kong. "Either you're going to have last minute moves today and tomorrow to get positions in place and take them off, or when we come back - we're going to get some decent volatility then."

The virus has dented what had been growing enthusiasm toward equities. Confidence was riding high as Beijing signed a phase one trade deal with the US and data signaled China's economy was stabilising.

Margin debt had topped 1 trillion yuan as investors took on leverage to chase the rally, while privately-offered funds boosted their stock positions to the highest since early 2015.

"Markets were too heated up and there is room for profit taking," said Nader Naeimi, head of dynamic markets at AMP Capital Investors. "We have sold Hong Kong shares, China A futures against the long broad EM basket this week. We're just waiting for some heat and froth to come out before closing the shorts."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Afghanistan Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Afghanistan Sun.

More InformationInternational

SectionJapan’s cherry blossom season officially begins in Tokyo

TOKYO, Japan: This week, Japan's cherry blossom season officially began as experts confirmed the first blooms in Tokyo. A specialist...

67,000 Seek U.S. Refugee Status Under Trump’s White Minority Plan

CAPE TOWN, South Africa: The U.S. Embassy in South Africa said it received a list of over 67,000 people interested in refugee status...

North Carolina court allows suit over teen’s unapproved COVID shot

RALEIGH, North Carolina: North Carolina's highest court has ruled that a mother and her teenage son can pursue a lawsuit over a COVID-19...

Florida City to train local police for immigration enforcement

WEST PALM BEACH, Florida: City officials in Fort Myers, Florida, voted last week to approve a new agreement allowing local police to...

US unveils plan to modernize air traffic control amid safety concerns

WASHINGTON, D.C.: With flight delays rising and aviation safety under scrutiny, the U.S. government is preparing a sweeping modernization...

NTSB calls for urgent safety checks on 68 US bridges, including icons

WASHINGTON, D.C.: The U.S. National Transportation Safety Board (NTSB) has called for urgent safety checks on 68 bridges, including...

Central Asia

SectionIPL 2025: Will Virat's slog-sweep work against CSK's spin duo of Noor-Ashwin?

Chennai (Tamil Nadu) [India], March 28 (ANI): When Royal Challengers Bengaluru (RCB) take on five-time champions Chennai Super Kings...

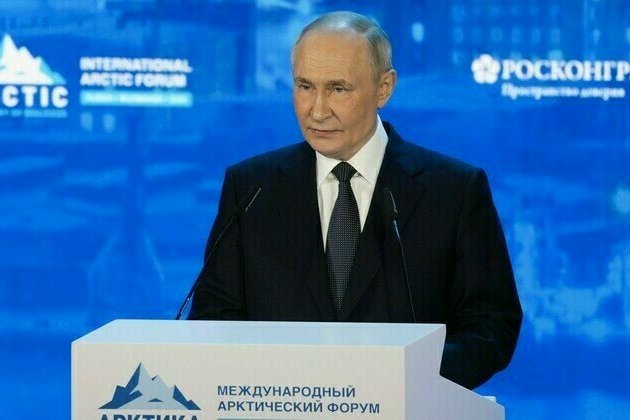

Putin outlines Russian plans for Arctic (FULL TEXT)

The president has urged sustainable development of the region and addressed the global implications of the US claim to Greenland ...

ChineseToday | Doctors from Shenzhen provide healthcare services to villagers on Pamir Plateau

(250328) -- TAXKORGAN, March 28, 2025 (Xinhua) -- Pan Qian (1st L), a doctor from Shenzhen, talks with villagers and local medical...

Asian Wrestling Championships 2025: India wrestler Reetika narrowly misses out on gold, settles for silver

Amman [Jordan], March 28 (ANI): Reetika Hooda, the reigning Under-23 world champion, bagged a silver medal in the women's freestyle...

Ambassadors of Muslim-majority nations hail India's strong ties with Islamic world

New Delhi [India], March 28 (ANI): Ambassadors and diplomats of Muslim-majority nations hailed India's strong ties with the Islamic...

Afghans prepare for Eid amid economic hardships, despair

People shop at a local market ahead of the upcoming Eid al-Fitr in Kabul, Afghanistan, March 27, 2025. (Photo by Saifurahman Safi/Xinhua)...